Please refer to important disclosures at the end of this report

1

I

ncorporated in 1981, Paradeep Phosphates Limited is a manufacturer of

non-urea fertilizers in India. The company is part of the Zuari group and

is

engaged in manufacturing, trading, distribution, and sales of a variety of

complex fertilizers such as DAP, three grades of Nitrogen-Phosphorus-

Potassium (namely NPK-10, NPK-12, and NP-20), Zypmite, Phospho-

gypsum and Hydroflorosilicic Acid. Paradeep P

hosphates Limited is the

second largest private sector manufacturer of non-urea fertilizers and Di-

Ammonium Phosphate(DAP) in terms of volume sales for the nine months

ended December 31, 2021. The company's fertilizers are marketed under

the brand names Jai Kisaan-Navratna and Navratna.

Positives: (a) Second largest manufacturer of Phosphatic fertilizers in India

(b)

Cost reductions

through backward integration of facilities and effective sourcing

(c)

Established brand name backed by an extensive sales and distribution

network (d) Secure and certified manufacturing facility and infrastructure

(e)

Unutilized land available for expansion

Investment concerns: (a)

Business has high dependence on performance of

agricultural sector.

(b) Highly Regulated industry. (c) Business is subject to climate

conditions and is cyclical in nature.

Outlook & Valuation:

The issue comprises both of an offer for sale and fresh

issue. While the Government of India will be selling its entire

20% holding in the

company Zuari Maroc Phosphates Pvt Ltd.

will also be selling part of its holding

in the offer for sale. In terms of valuations, the stock will trade at post issue

P/E

multiples of 15.3xFY2021 EPS (at the upper end of the issue price band), which

is in line with other players like Chambal fertilizer and Deepak fertilizer though

they may not be strictly comparable. Given t

he fact that the company is valued

in line with peers and likely to face headwinds in terms of cost pressures due to

recent increase in raw material prices, we recommend a NEUTRAL rating on the

issue.

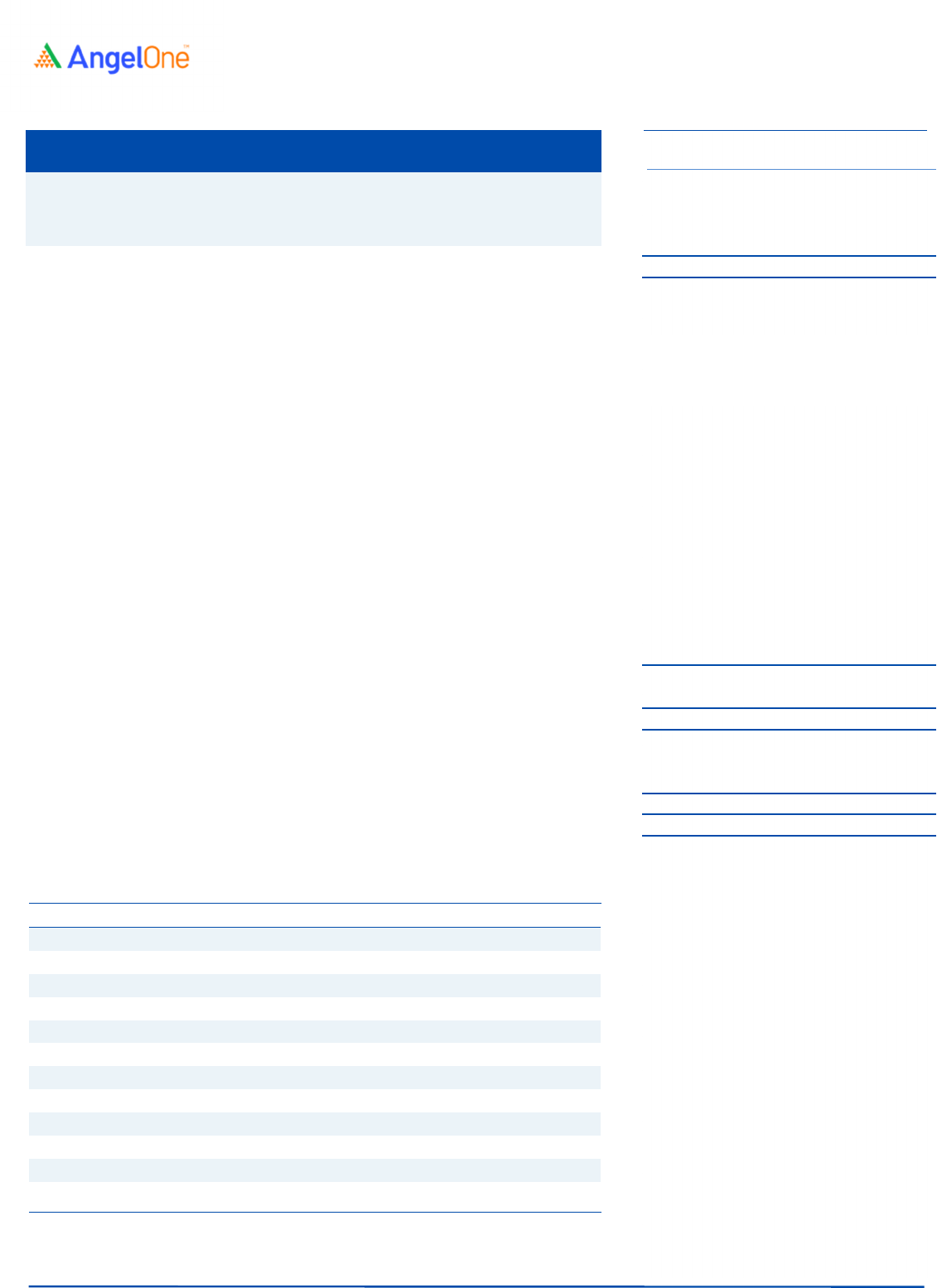

Key Financials

Y/E March (` cr) FY2019

FY2020 FY2021 9MFY22

Net Sales

4,358

4,193

5,165

5,960

% chg

(3.8)

23.2

Net Profit

159

193

223

363

% chg

22.6

15.6 -

OPM (%)

8.5

9.2

8.9

8.6

EPS (`)

2.8

3.4

3.9

6.3

P/E (x)

15.2

12.5

10.8

-

P/BV (x)

1.6

1.5

1.3

-

RoE (%)

10.7

12.1

12.2

-

RoCE (%)

8.1

9.9

14.9

-

EV/Sales (x)

1.3

1.1

0.7

-

EV/EBITDA (x)

12.5

10.2

6.4

-

Angel Research; Note: Valuation ratios based on post-issue shares and at `42per share.

Neutral

Issue Open: May 17, 2022

Issue Close: May 19, 2022

Fresh Issue:

`1,004cr

QIBs 50%

Non-Institutional 15%

Retail 35%

Promoters 56.1%

Public 43.9%

Offer for sale:

`498cr

Issue Details

Face Value:

`10

Present Eq. Paid up Capital:

`575cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital:

`815

cr

Issue size (amount):

`1,502cr

Price Band:

`39

-42

Lot Size: 350 shares

Post-issue mkt.cap:

`3,248

*– 3,421cr**

Promoter holding Pre-Issue: 100%

Promoter holding Post-Issue: 56.10%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Amarjeet S Maurya

Amarjeet.maurya@angelbroking.com

+022 4000 3600, Extn: 6810

Paradeep Phosphates IPO

IPO Note |

FERTILIZER

May 13, 2022

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

2

Company background

Paradeep Phosphates Limited is a public company headquartered in

Bhubaneswar, India. Zuari Agro Chemicals Limited (ZACL) holds 40.23% of

equity shares of Paradeep Phosphates Limited through its joint venture Zuari

Maroc Phosphates Private Limited (ZMPPL). The Company is primarily engaged

in the manufacture of Di-Ammonium Phosphate (DAP), Complex Fertilizers of

NPK grades, and Zypmite (Gypsum based product) having its manufacturing

facility at the port town of Paradeep, District Jagatsinghpur, Odisha. The

Company is also involved in trading of fertilizers, ammonia, neutralized phospo

gypsum, micronutrient, and other materials.

The Company caters to the demands of farmers all over the country through its

“Navratna” brand of fertilizers. The Company has one associate incorporated

in Myanmar under the name of Zuari Yoma Agri Solutions Limited.

Issue details

PPL is raising ₹497.7cr through OFS and ₹1,004cr through Fresh Issue

in the

price band of ₹39-₹42 per share.

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue) %

Promoter 57,54,50,000 100.00% 45,69,42,507 56.10%

Public 0 0.00% 35,75,55,112 43.90%

Total 57,54,50,000 100.00% 81,44,97,619 100.00%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

The net proceeds of the Fresh Issue are proposed to be utilized in the

following manner:

Repayment or pre-payment of certain borrowings availed by the Company.

Part-financing the acquisition of the Goa Facility

General corporate purpose

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

3

Key Managerial Personnel

Sabaleel Nandy is the President and Chief Operating Officer. He joined the

Company on August 1, 2020. He holds a bachelor’s degree in technology (civil

engineering) from Indian Institute of Technology, Kharagpur and a post-graduate

diploma in management from Indian Institute of Management, Lucknow. He serves

on the boards of ZMPPL, Zuari Farm Hub Limited and ZYASL. Previously, he was

associated with Tata Chemicals North America as an executive director. He was also

the head of manufacturing of the Tata Chemicals Limited plant in Haldia.

Pranab Kumar Bhattacharyya is the Chief Manufacturing Officer – PPL Plant. He

joined the Company on July 1, 2016. He holds bachelor’s degrees in science and

technology (chemical technology – ceramic engineering) from University of Calcutta.

He also successfully completed the post-graduate executive management program

from the S.P. Jain Institute of Management and Research, Mumbai. Previously, he

was associated with Hindalco Industries Limited as an assistant general manager.

Alok Saxena is the General Manager and Head of Corporate Finance. He joined

the Company on November 1, 2020. He holds a bachelor’s degree in technology

(computer engineering) from Govind Ballabh Pant University of Agriculture and

Technology and successfully completed a post-graduate program in management

from the Great Lakes Institute of Management, Chennai. Previously, he was

associated with Tata Consultancy Services as a systems engineer. He has been with

Adventz group for over a decade and has handled key strategic, business

transformation, M&A and commercial portfolios within the group

Sachin Patil is the Company Secretary and Compliance Officer. He joined the

Company on November 4, 2020. He holds a bachelor’s degree in corporate

secretariship (first class with distinction) from Karnatak University, Dharwad. He is

an associate member of the Institute of Company Secretaries of India. He was earlier

associated with Zuari Global Limited as Assistant Company Secretary and

Compliance Officer.

Bijoy Kumar Biswal is the Chief Financial Officer. He joined the Company on

November 6, 2021. He is a member of the Institute of Chartered Accountants of

India in 1998. He was earlier associated with Forte Furniture Products India Private

Limited as Chief Financial Officer.

Harshdeep Singh is the Chief Commercial Officer since March 29, 2022. He joined

the Company on September 16, 2015. He holds a bachelor’s degree in engineering

(chemical engineering) from Sambalpur University and master’s degree in business

administration (international business) from Indian Institute of Foreign Trade.

Previously, he was associated with Tata Chemicals Limited as an assistant vice

president - commercial

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

4

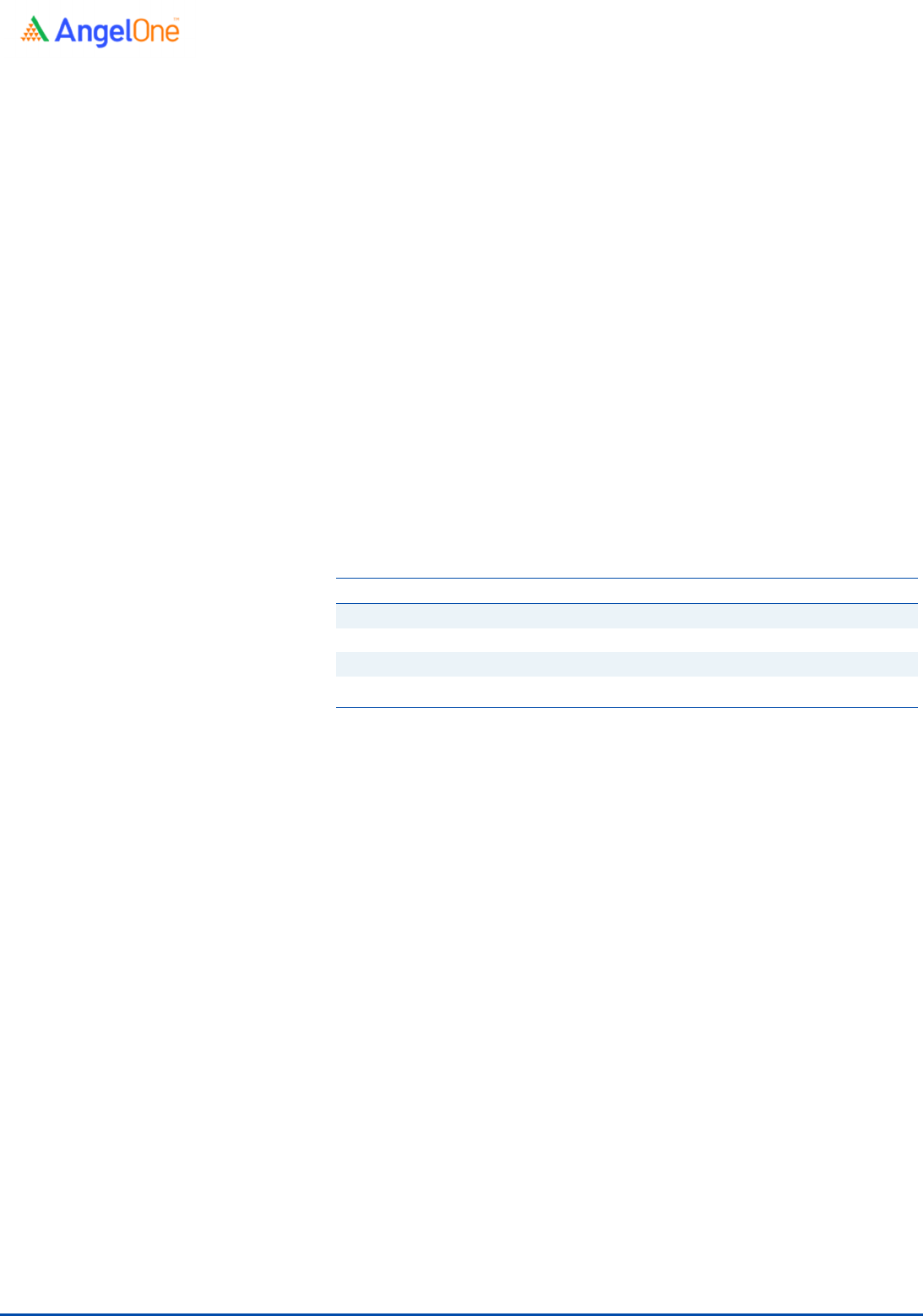

Exhibit 2: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020 FY2021

Net Sales

4,358

4,193

5,165

% chg (3.8)

23.2

Total Expenditure

3,916

3,733

4,622

Raw Material

3,124

2,944

3,871

Personnel

131

132

139

Other Expenses

661

657

612

EBITDA

442

460

542

% chg

4.1

17.9

(% of Net Sales)

10.1

11.0

10.5

Depreciation & Amortization

70

72

83

EBIT

371

387

459

% chg

4.3

18.5

(% of Net Sales)

8.5

9.2

8.9

Interest & other Charges

159

192

111

Other Income

39

35

19

(% of PBT)

15.6

15.2

5.2

Recurring PBT

251

230

367

% chg (8.4)

59.2

Tax

92

36

143

(% of PBT)

36.8

15.8

39.1

PAT before P/L of Associate

159

194

223

% chg

22.0

15.2

Share in profit of Associate

(0)

(1) (0)

PAT

159

193

223

Basic EPS (Rs)

2.8

3.4

3.9

Source: Company, Angel Research

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

5

Consolidated Balance Sheet

Y/E March (` cr) FY2019 FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital

575

575

575

Reserves& Surplus

907

1,028

1,252

Shareholders’ Funds

1,483

1,604

1,828

Total Loans

3,123

2,298

1,251

Other Liabilities

20

27

20

Total Liabilities

4,626

3,929

3,099

APPLICATION OF FUNDS

Net Block

1,024

1,214

1,226

Capital Work-in-Progress

255

149

220

Investments -

3

125

Current Assets

4,315

3,605

2,816

Inventories

1,422

1,079

899

Sundry Debtors

2,342

2,149

1,156

Cash

20

6

93

Loans & Advances - - -

Other Assets

531

372

669

Current liabilities

975

1,060

1,232

Net Current Assets

3,340

2,545

1,585

Deferred Tax Liabilities (26) (22) (93)

Other Assets

33

39

36

Total Assets

4,626

3,929

3,099

Source: Company, Angel Research

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

6

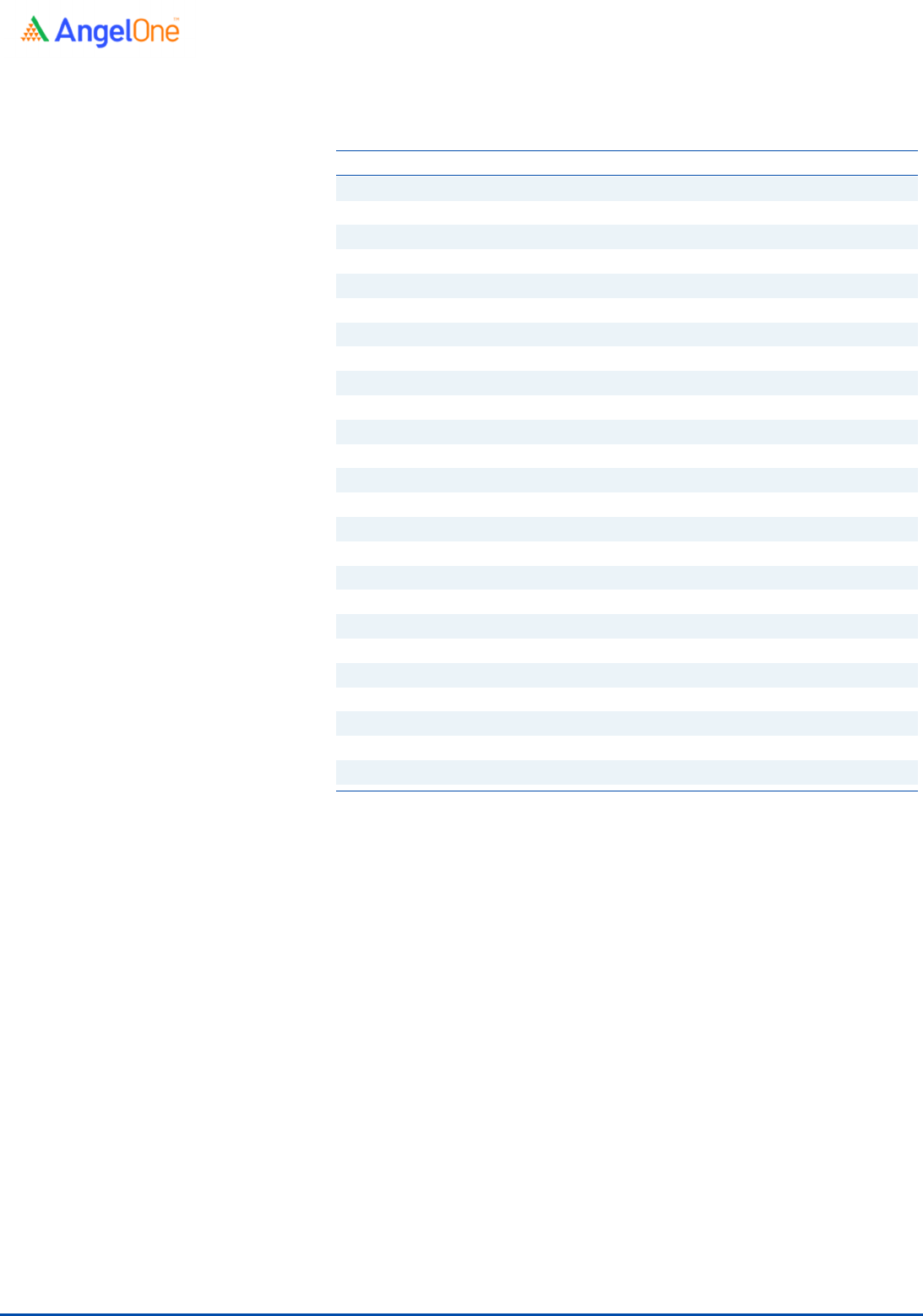

Exhibit 3: Consolidated Cash Flow Statement

Y/E March (` cr) FY2019 FY2020

FY2021

Profit before tax 251 230

367

Depreciation 70 72

83

Change in Working Capital -1,305 778

993

Interest / Dividend (Net) 119 174

101

Direct taxes paid -36 -29

-77

Others -19 46

35

Cash Flow from Operations -920 1,271

1,501

(Inc.)/ Dec. in Fixed Assets -126 -139

-169

(Inc.)/ Dec. in Investments 5 -6

-121

Interest Received 18 1

1

Cash Flow from Investing -103 -143

-289

Inc./(Dec.) in long term loans -59 -69

-30

Inc./(Dec.) in short term loans 1,312 -794

-976

Dividend Paid (Incl. Tax) -69 -69

0

Interest / Dividend (Net) -165 -209

-118

Cash Flow from Financing 1,018 -1,141

-1,124

Inc./(Dec.) in Cash -5 -14

88

Opening Cash balances 24 19

4

Closing Cash balances 19 5

92

Source: Company, Angel Research

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

7

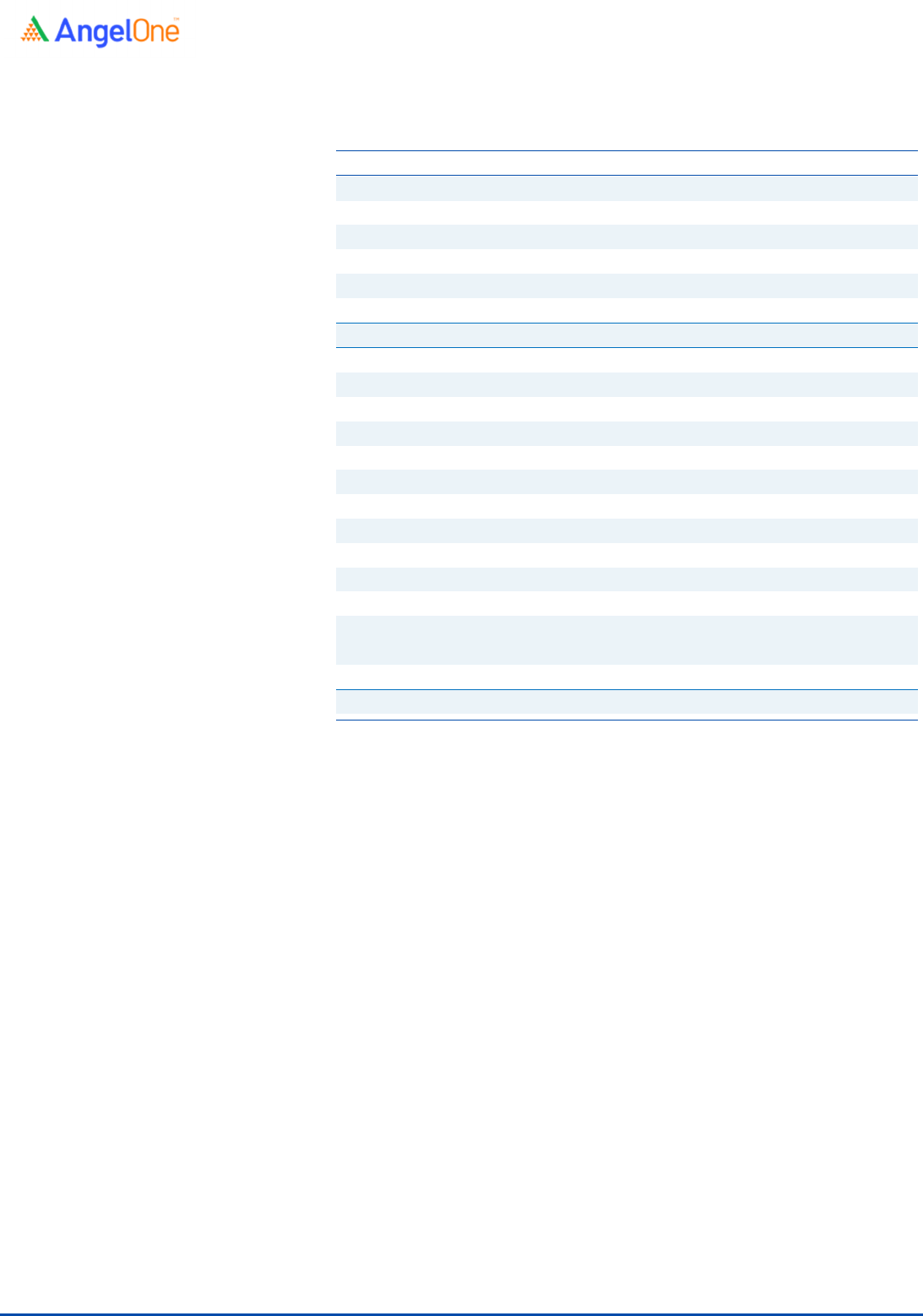

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

15.2

12.5

10.8

P/CEPS

10.6

9.1

7.9

P/BV

1.6

1.5

1.3

EV/Sales

1.3

1.1

0.7

EV/EBITDA

12.5

10.2

6.4

EV / Total Assets

1.2

1.2

1.1

Per Share Data (Rs)

EPS (Basic) 2.76

3.36

3.88

EPS (fully diluted)

2.8

3.4

3.9

Cash EPS

4.0

4.6

5.3

Book Value

25.8

27.9

31.8

Returns (%)

ROCE

8.1

9.9

14.9

Angel ROIC (Pre-tax)

8.1

9.9

16.0

ROE

10.7

12.1

12.2

Turnover ratios (x)

Asset Turnover (Net Block)

4.3

3.5

4.2

Inventory / Sales (days)

119

94

64

Receivables (days)

196

187

82

Payables (days)

59

70

66

Working capital cycle (ex-cash) (days)

256

211

79

Source: Company, Angel Research

Paradeep Phosphates Limited | IPO Note

M

ay

13

, 2022

8

Research Team Tel: 022 - 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking

or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel

or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection

with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.